Certificados De No Propiedad

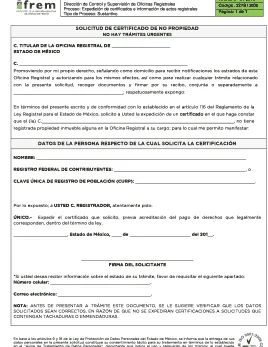

En este artículo exploraremos el significado y el propósito de un Certificado de No Propiedad. Se explicará qué tipo de documentación se necesita para solicitar uno, los detalles de los documentos pertinentes, costos y cualquier requisito legal que puedan estar involucrados en la obtención de un certificado de no propiedad. Se discutirán los pasos para verificar un certificado, los usos comunes y cualquier problema potencial que los profesionales inmobiliarios y el público en general deban estar familiarizados para evitar.

Certificados De No Propiedad

What is a Non-Ownership Certificate?

A Non-Ownership Certificate is a document that confirms that a certain property doesn’t belong to an individual or institution. The ownership of the property is certified to be of the public domain or has no clear owner. A Non-Ownership Certificate is used to ensure that an individual or organization has legal permission to manage, use or acquire a certain property.

Non-Ownership Certificates are used in various settings including real estate, corporate enterprises and public records. These documents often include details about the owner and nature of the property, as well as the applicable laws associated with it. Non-Ownership Certificates are used to establish clear ownership rights, clarify legal matters and establish ownership of the property in question.

In the US, the IRS requires a Non-Ownership Certificate if a property is transferred to a third-party and the new owner has to complete a tax filing. This ensures that the previous owner is not liable for any taxes associated with the property. Likewise, some corporations require a Non-Ownership Certificate if they are buying or selling a property, as they need to confirm that they are the legal owners.

Advantages and Benefits of Non-Ownership Certificates

When it comes to avoiding legal or financial penalties, having a Non-Ownership Certificate is often critical. These documents can provide protection against disputes regarding ownership and can also help resolve any ambiguities over the ownership of a given property. In addition to avoiding financial liabilities, Non-Ownership Certificates can also be used to ensure that a property is properly documented and can be transferred between parties in the future.

By using a Non-Ownership Certificate, businesses and individuals can also ensure that their property is registered with the appropriate public records. This ensures that people have access to the exact details relating to ownership, and that the property is protected from being owned by someone else. Non-Ownership Certificates are an important aspect of the business process and can provide a layer of protection against legal complications and disputes.

Non-Ownership Certificates and Taxes

When it comes to taxes, Non-Ownership Certificates can be beneficial to individuals and businesses in a variety of ways. For one, they can help identify the legal owner of a property and ensure that the correct taxes are paid when the property is transferred or sold. In addition, Non-Ownership Certificates are often used as evidence in court to establish ownership rights if they are disputed.

In some cases, a Non-Ownership Certificate can also be used to reduce taxation liabilities. This is done by submitting a form to the IRS and other relevant public records offices to clarify that the property is not owned by the individual or organization and does not contribute to their taxable income. By reducing any financial obligations on the ownership of a certain property, Non-Ownership Certificates can help businesses and individuals save money.

Using Non-Ownership Certificates as a Business Tool

Non-Ownership Certificates can be a valuable tool for businesses. By obtaining these documents, businesses can prove that they have the right to use and own a given property, and can protect themselves against any disputes concerning ownership. This can help businesses save money on taxes and avoid costly legal disputes, allowing them to proceed with the business process with the assurance that their assets are secure.

Non-Ownership Certificates can also be used to help businesses identify properties that are available for sale or transfer. These documents can provide an accurate list of properties that are owned by an individual or organization and are available for purchase or transfer. This can streamline the business process and help businesses identify the best investments for their purposes.

Adhering to Laws When Obtaining a Non-Ownership Certificate

When filing a Non-Ownership Certificate it is important to follow relevant local, state and federal laws. Depending on the type of property, different methods may need to be used to confirm ownership and all applicable taxes must be paid. In addition, different public records and other institutions may need to be consulted to ensure that all applicable laws are followed.

It is also important to be aware of any applicable fees when filing a Non-Ownership Certificate. The fees can vary depending on the type of property and the state. In some cases, the fees may be waived, but it is important to consult with a specialist to ensure that all necessary costs are taken into account. By being aware of the applicable laws and costs, businesses and individuals can ensure that their Non-Ownership Certificate is accepted by the relevant authorities.

Conclusion

En conclusión, los certificados de no propiedad son una herramienta útil para los propietarios potenciales de una propiedad al momento de la compra. Gracias a ellos, salvan de muchos riesgos de demandas civiles u otros problemas legales a los compradores, ya que ellos demuestran que la persona que vende no es el verdadero propietario de la propiedad. Tener un certificado de no propiedad como documentación adicional antes de la compra, es una forma de proteger tu inversión.

Si quieres conocer otros articulos parecidos a Certificados De No Propiedad puedes visitar la categoría Tramites.

Más Trámites parecidos